The Market Owes You Nothing

Invest for long enough in the stock market and you’re destined to exclaim: “I didn’t expect that!” (Or, something to that effect: “I can’t believe it!”, “Wow!”, “Holy s**t!”) Probably many times.

You could be a longtime investor who was unphased by every bubble, bust and crash of the past 60 years. You can be Stoic philosopher Epictetus reincarnated in a day trader. It does not matter.

Eventually, the market will surprise you – and if you’re not careful, scare you.

Case in point: 2020. Let’s be honest. How many of us have had a hard time keeping up with the market this year amidst a global pandemic, political gridlock and social unrest?

As James B. Stewart, author of the classic Den of Thieves, wrote in the New York Times back in March: “I became a disciplined investor over 40 years. The virus broke me in 40 days.” The pandemic and subsequent market turmoil was enough to even give Warren Buffett pause, leading Josh Brown to wonder what version of Buffett this is.

You can have a finance degree, billions of dollars, the best technology, a team of advisors working for you. Those may increase your chances of success, or maybe not.

The market is deaf to the intentions of its buyers and sellers. Where it goes on any given day and the reasons why are essentially arbitrary. It’s part of the deal. As Morgan Housel has said, volatility is the price of admission.

Despite that, the stock market is our best option for growing money. That’s why we invest.

Just as long as you keep going.

To keep going often requires the right perspective to then lead you to the right action.

What’s that? Expect nothing.

Investing as a marathon

My very first marathon, in Detroit, was an unforgettable experience -- and it was a failure. I made an ambitious goal to qualify for the Boston Marathon, which is notoriously difficult.

For my age group, I would have had to finish around 2 hours and 55 minutes. I missed it by more than half an hour.

Even after dedicating myself to a rigorous training regimen, it didn’t matter. Because as marathoner Peter Bromka writes, “The marathon doesn’t owe you anything.”

The market works the same way. The market owes you nothing.

Perhaps the two most important qualities of a marathon runner are not strong legs or special shoes, but grace and humility. The world’s fastest marathon runner Eliud Kipchoge displayed such character after coming in a pedestrian (for him!) eighth place in the 2020 London Marathon, a race he has dominated. He said: “Sport is unpredictable, but you know what they say: If you want to enjoy sport then you accept the results. So I accept the result and congratulate all finishers.”

This week, steep daily drops returned to the market. It is also the week following what should have been my second run of the Detroit Marathon, which was canceled due to the pandemic. So I’ve been thinking about the similarities between investing and running a marathon.

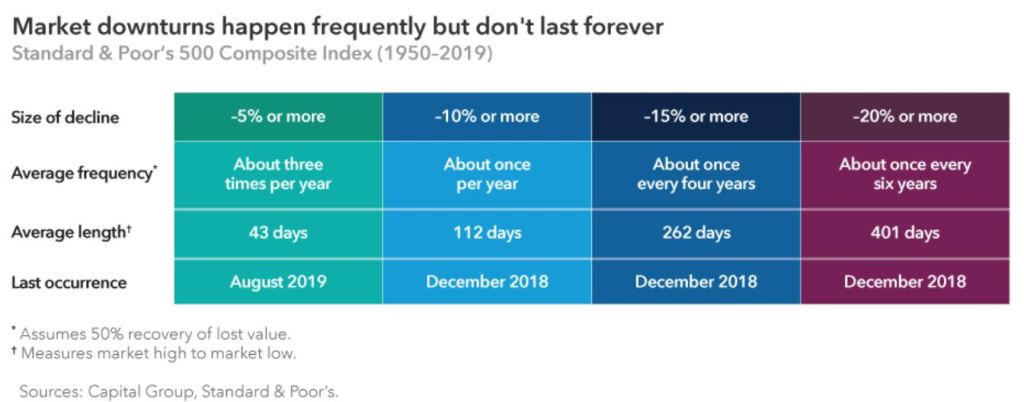

Grace and humility are not two things conventionally linked to successful investors. But they can be extremely useful during the down times, which happen more frequently than many people think.

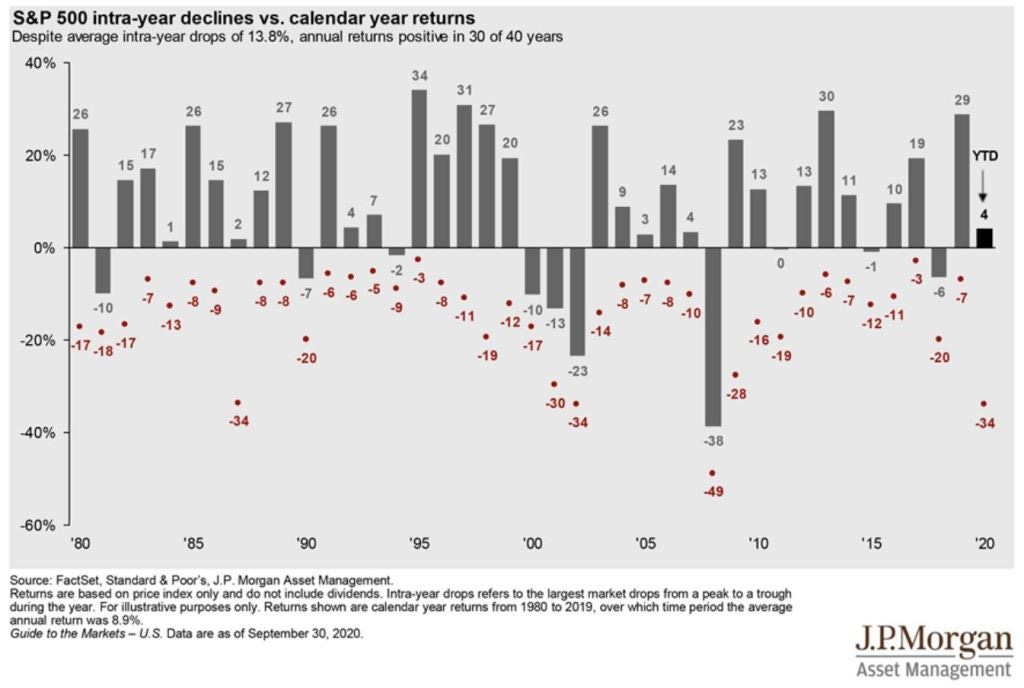

The average intra-year market decline since 1980 is 13.8%, according to JP Morgan.

Yet annual returns were positive for 30 of those 40 years. It is worthwhile then to humbly accept volatility as normal and gracefully keep investing.

Please don’t get me wrong. Talk of investor mentality and behavior can be overblown. Investors aren’t as fearful as we like to think, as evidenced by how many 401(k) investors stayed put back in February and March.

But when that moment comes that makes you question yourself, the right perspective helps you choose the right action, which is usually a decision between staying the course and making a huge mistake.

As I reached the mid-point of my first marathon and started to realize I wouldn’t achieve my goal, I kept running. I knew at least I could still proudly reach the finish line. The marathon didn’t owe me anything.

Short-term pain vs. long-term gain

A marathon is long – 26.2 miles. You are always at risk of your body unexpectedly breaking down. A marathon is outdoors. You are always at the mercy of the elements – rain, snow, heat.

Race day can go in one of a million directions. All you can control is how you train before the start and the faith you put in your plan during the race. The distance never changes, and the satisfaction of finishing is worth all the pain every time. No one finishes with regrets of having started.

That difference between short-term pain and long-term gain also applies to the market.

There will be highs, lows, bulls, bears. You can’t predict when they occur or for how long. But over time the direction has been the same. Up. As an investor then, it is worth it to commit to the historical uphill reward, even after the steepest falls.

The market has rebounded from every decline of 15% or more, from 1929 through 2019. And the average return in the first year after each of these declines was 54%, according to Capital Group.

It is you who owes

What you get out of a marathon is what you put in. That is not a result of only my biology and my circumstances, but also my work ethic and attitude. It is what you owe to run a marathon.

You are the one who owes when building wealth. You owe it to your ideal future self.

You owe it to yourself to live below your means.

You owe it to yourself to save every month.

You owe it to yourself to never pay more in fees than necessary.

You owe it to yourself to stay the course.

You owe it to yourself to focus on your goals and your dreams – never the money itself.

Sure, it would be more exciting to sprint to wealth, with those double-, triple-digit returns we dream about. But you’re more likely to burn out. Even the people whose job it is outperform the market tend to come up short.

Just attempting to run a marathon is a feat, as is simply saving in a retirement account. Many don’t even get that far. The New York Federal Reserve found that more than a third of eligible workers were not participating in their 401(k) plans.

Luck surely helps. Grace and humility allows us to better take advantage of that luck. You don’t know more than the market. And the market owes you nothing.

As an investor you can feel content to keep going at a pace you’re comfortable with to stay solvent and reach your financial goals – your retirement, your vacation home, your child’s education..

The perspective is worthless on its own; what matters is the action, or inaction, that follows it.

For me, I still have dreams of reaching Boston. If I keep at it, I may get there. Even if I don’t, what do I lose? I will have enjoyed many miles and races that have greatly benefitted my physical and mental health, which is all enriching in itself.

Excuse me for mixing sports metaphors, but the market doesn’t owe you home runs. However, it is pretty generous with enough singles to get you around the bases, if you give it the time.

The market owes you nothing, which makes it all the more remarkable when it gives you everything.

Friday Five

Ben Carlson gracefully writes about the 5 things you can truly invest in

Who you spend your time with, what you spend your time on, and where you spend your time are some of the most important decisions you can make in life.

This is true if you have a lot of money or not.

The Accumulator gives us the facts of investing life

The basic facts are much easier to acquire for an amateur than superior skills. Knowledge is an all-you-can-eat buffet in the digital age. You can stuff your face with it via blogs and books.

The only question is what you choose to swallow.

Susan Orlean reveals all the tools you will ever need to become a writer

As for your writing surface, I’ve written on steno pads and legal pads and hotel stationery and boxtops and scratch pads and the inside of my wrist, but you can’t beat a reporter’s notebook.

Jessica Easto serves as a guide for making the best cup of coffee

Coffee – what’s called ‘drip’ or ‘filter’ coffee, not espresso – can taste smooth and sweet like chocolate, or provide a zip on your tongue like a bright Champagne, or taste fruity, just like a blueberry. And when I say ‘chocolate’ or ‘blueberry’, I mean the coffee itself literally tastes like those things, without any added syrups or flavourings. The first time you drink coffee that tastes like more than coffee, you’ll never forget it.

Friday Fiction: Eloghosa Osunde

I’ve always had a problem with introductions. To me, they don’t matter. It’s either you know me or you don’t—you get? If you don’t, the main thing you need to know is that I am a hustler through and through. I’m that guy that gets shit done. Simple.