One Thing to Remember About Improving Your Financial Habits

Tired hands, young and old; tired hands to assemble each plastic piece and screw every tiny screw; tired hands to pull levers and activate conveyor belts; tired hands to pack cardboard boxes and stack containers on steel ships; tired hands to navigate the weathered steering wheel of a semi-truck; tired hands to deliver it to my doorstep; all of which is jumpstarted by a performative gesture as a consumer with a well-rested index finger on a digital button.

It is the cycle of a normal holiday shopping season. The only way to break it is to individually not participate.

Often, what is most effective in changing our habits for the better isn't a stroke of good luck but a nice, serious crisis. But whether or not it does greatly depends on single decisions, which are what make up our virtues. Habits and virtues, after all, can't be turned on and off; they take practice.

As we near the end of year two of COVID, perhaps the pandemic hasn't changed our financial behaviors as much as we first thought.

I have never shopped on Black Friday. I just would rather feel as if my head has been stomped on because of too much wine during Thanksgiving dinner than actually have my head stomped on for a flat screen TV. Though I certainly don't look down upon those who do.

Except this year, it may be an opportunity to recommit to the financial habits we adopted at the peak of the pandemic. Because it also is a decision to make for the better, and you never want to let a Black Friday go to waste.

***

Barack Obama's reward for winning the 2008 presidential election was responsibility over the worst economic crisis since the Great Depression. At the time, his chief of staff, Rahm Emanuel, said, "You never want a serious crisis to go to waste. And what I mean by that is an opportunity to do things that you think you could not do before."

To view a crisis as an opportunity is a tenet rooted ancient philosophy, as echoed by Roman emperor and Stoic philosopher Marcus Aurelius: "Just as nature takes every obstacle, every impediment, and works around it...so, too, a rational being can turn each setback into raw material and use it to achieve its goal."

A serious crisis can be opportunistic event for politicians and for businesses (looking at you Peloton and Zoom); but it can be life-changing for people. It depends on our virtues, like prudence and temperance.

A crisis of the pandemic's magnitude can be viewed as creating opportunities in all areas of our lives, from our health to our jobs to our finances.

Surveys show the pandemic prompted people to reprioritize their financial lives, in most ways for the better. In the Charles Schwab's Modern Wealth Survey, around half of respondents said they would go back to living and spending as before COVID, but almost a third said they would live a quieter life and save more money. What's more, 80% said they would be bigger savers than spenders in 2021.

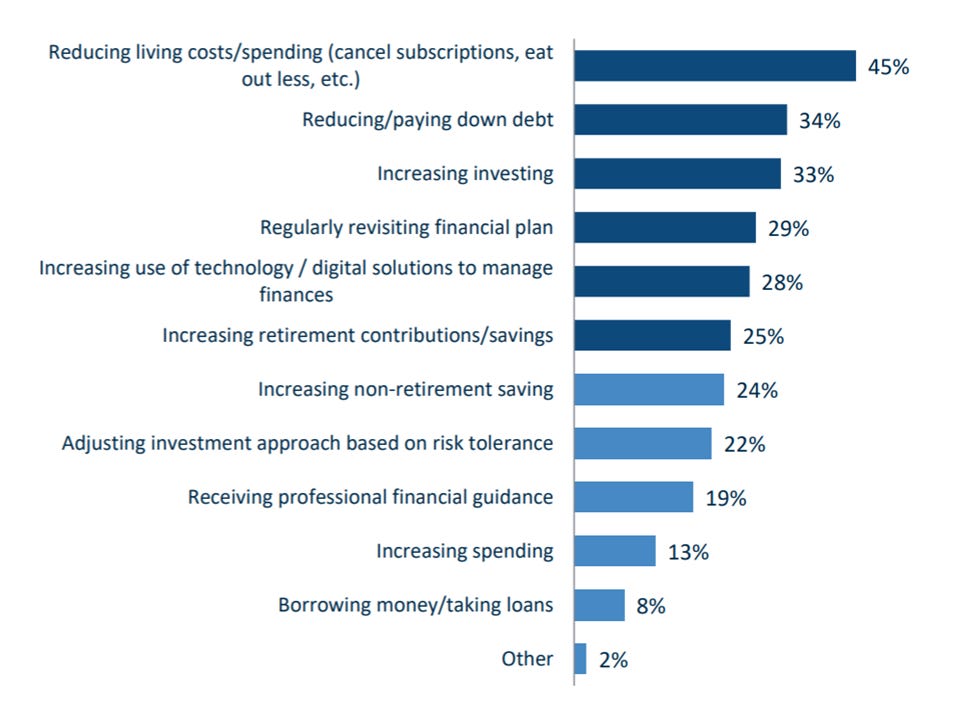

Couple that with Northwestern Mutual's Planning & Progress study where "reducing living costs and spending," such as canceling subscriptions and eating out less, topped the list of financial behaviors people adopted during the pandemic and expected to maintain going forward. That's followed by "paying down debt" and "increasing investing."

Of course, it's easy to make commitments when you have no other options. The challenge is to sustain them when conditions improve.

Unfortunately, the opportunity to improve our financial behaviors as a result of the pandemic seems to have passed.

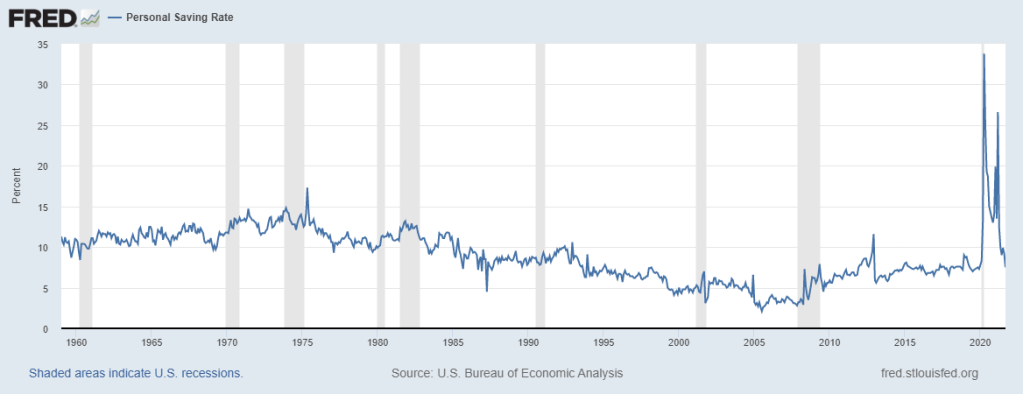

For example, the savings of Americans, which skyrocketed with the disbursement of stimulus checks, has fallen back to relatively normal.

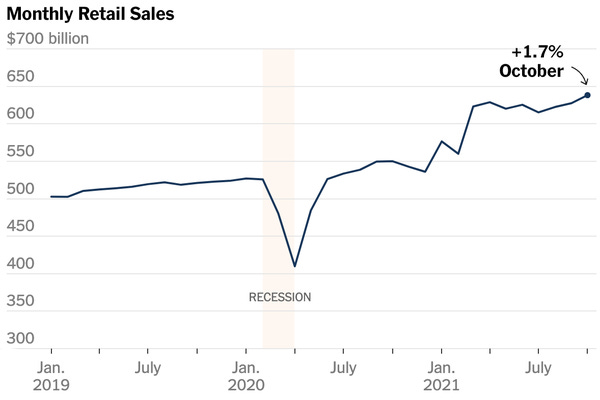

Meanwhile, higher prices and supply problems hasn't kept people from spending more and more.

Those of us who have procrastinated with our holiday shopping will have to simply accept giving the unwrappable gifts of love and companionship.

Maybe that is a gift in itself. After all, most people spend beyond their budgets when holiday shopping. And, more than a third of Americans return gifts, totaling more than $400 billion in returned merchandise. We could spend less or nothing at all and people would understand.

The enticement of Black Friday deals that turn to disappointment because everything is late or out of stock could be seen as a reminder to detach ourselves from the things that don't provide lasting value. There is no waiting time for virtue.

Surely, there is nothing inherently wrong with consumption. It's what America runs on, along with Dunkin Donuts. But there is something wrong with mindlessly consuming, to give a gift just to give a gift, to ignore our place in the cycle of things, to spend with nary a thought off its impact on other people, the planet and our wealth.

And, there is something wrong with not seizing opportunity. That is a choice that will have to be made again and again.

I'm not sure that our financial habits will dramatically change once the pandemic is officially over. It's just too easy to buy stuff.

But that's okay. At least it has shown us that we can do things that we think we could not do before -- to spend less, to save more, to invest more.

And it has shown how small decisions, such as choosing to sleep in on Friday, connects to our virtues.

As another Stoic philosopher, Seneca, said: "Misfortune is virtue's opportunity."