Minding Your Blind Spots

Your greatest financial ally could be the person you share your bed with.

One reason people make costly mistakes is blindness. I am blind; you are, too. We're all blind, in some way. And we don't know it. Except for the self-aware, humble ones.

Horror legend Stephen King has written around 50-60 bestselling novels and won dozens of literary awards. Yet, he doesn't fully trust his judgment when crafting a new book. In the modern classic, On Writing, he explains his writing process. After completing the first draft, he sets the manuscript aside long enough to create the illusion of reading it for the first time as he begins editing. Once he finishes making revisions, he gives it to his wife, and sometimes a few close friends, to read first.

King's first reader, his wife or others, can identify any weaknesses he did not see, from plot holes and underdeveloped characters to grammatical mistakes and factual errors, like the wrong manufacturer of a gun that will inexorably kill someone or many someones. Essentially, she helps improve the integrity of his work by revealing his blind spots.

Blind-Spot Bias... I See It Everywhere!

What about you? Who calls out your blind spots?

I have a strong feeling many of the investment mistakes being made today are primarily a result of one pernicious bias.

Blind-spot bias is the tendency to think we don't suffer from bias, all while we see it in others more than ourselves. It's a growing problem. Social media has made us more polarized, which is another way of saying more blind. Especially, at it pertains to financial information.

Platforms like Twitter and Reddit often turn into verbal turf wars over cryptocurrency, Tesla, interest rates, modern monetary theory and so on. They become places to argue about everyone's blind spots but our own. There are those so set in their ways they reject anything new. Then there are those so convinced they are changing the world they ignore history.

It is tribalism writ large. And I think this is dangerous as more people "consult" the internet for help making investment decisions.

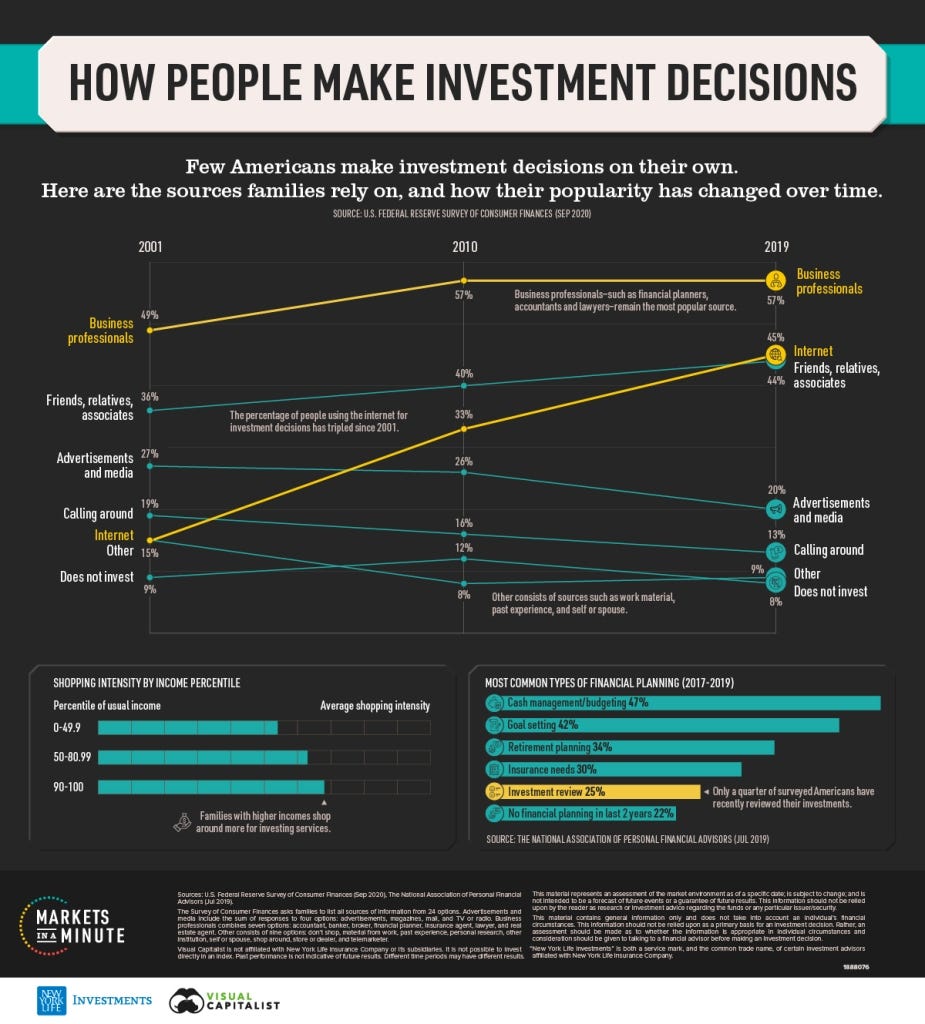

The number of families who rely on the internet for investment advice has risen rapidly over the past 20 years, trailing only financial professionals, according to the U.S. Federal Reserve Survey of Consumer Finances.

The trend is both encouraging and troubling. On the plus side, it's an indication that more people are interested in investing, which is good. More people learn about the market, and more people invest for their futures. Yea!

The down side is that there is a lot of misinformation online. Those with the loudest voices and deepest convictions take up the most space. It is easy to become polarized about money and less aware of your blind spots.

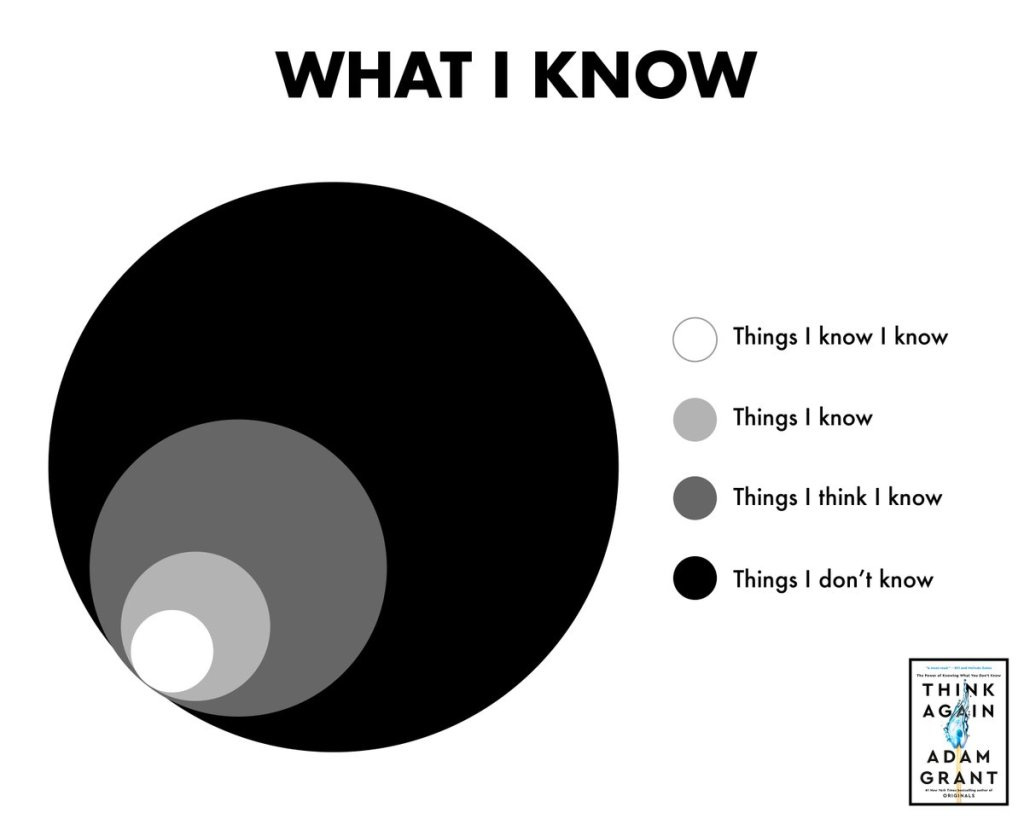

Another published author who actively seeks feedback from others is organizational psychologist Adam Grant. Blind-spot bias is a major theme of his latest book, Think Again.

He writes:

As we sit with our beliefs, they tend to become more extreme and more entrenched... We’re swift to recognize when other people need to think again.... Unfortunately, when it comes to our own knowledge and opinions, we often favor feeling right over being right. In everyday life, we make many diagnoses of our own, ranging from whom we hire to whom we marry. We need to develop the habit of forming our own second opinions.

What's so harmful about trusting your own opinion?

Ask Stephen Greenspan.

One example Grant uses in his book is the story of Mr. Greenspan, who decided to invest a third of his retirement savings in a promising investment fund. A close friend advised him to avoid the fund, as it seemed too risky. But the fund came highly recommended by a family friend, who was a financial adviser. Plus, the performance numbers were sensational. Mr. Greenspan was thrilled as his money steadily grew. Then the fund was wiped out and the fund's manager, a man named Bernie Madoff, went to jail.

Grant's proposed solution is to think more like a scientist -- to doubt what we think we know and update our views based on new information. He admits though that mindset isn't flawless. Because no one is immune to blind spot bias, even people we think are acutely concerned about being right. People like doctors.

A study on blind-spot bias revealed that physicians who receive gifts from pharmaceutical companies say such gifts do not influence their decisions on what medication to prescribe. That is the ethical thing to say, except the majority of those same physicians also say the decisions of other physicians are likely unconsciously biased by the gifts. So, what they really believe is that those gifts do influence those kind of important medical decisions, but just not for themselves, of course.

I think one contributing factor in this study is the gifts, the reward. Rewards, like money or social media attention, seem to reinforce blind-spot bias. Consider media organizations, news personalities, podcasters, etc., that start to lean toward certain ideologies as more entrenched viewpoints lead to higher engagement, which means more ad revenue or supplement sales.

We can find financially induced blind-spot bias in our own lives: justifying time away from family to work grueling hours for a bigger salary; committing to a company that does things that are contrary to our personal morals; spending $1,000 in lotto scratch off tickets for the excitement of winning $100; making terrible investment decisions for the up votes on an online forum.

As Morgan Housel says:

Investing is not the study of finance. It’s the study of how people behave with money.

The Beauty in Our Faults

Whether as a writer or investor, successful people rarely do it all alone. We can't see everything. Successful people know the value of another pair of eyes.

There is something wonderful about understanding our own faults. And that is the remarkable opportunity in figuring out how to overcome them. With blind-spot bias, the solution is its own reward: forming a deeper relationship with someone who gracefully gives you an honest second opinion, something that is invaluable when it comes to financial decisions.

Such a relationship can be with a spouse or a friend or a colleague or financial adviser. Whomever you choose, the relationship is liable to change more than just your finances but your life in general.

So, share your art, no matter how bad you think it is. Share your financial life with someone, no matter how embarrassed you may feel.

The beauty of our individual flaws is that in them exists the opportunity to connect with others.

As King writes:

"You can't let the whole world into your story, but you can let in the ones that matter most. And you should."