Do Your Financial Goals Match Your Values?

Tony Hsieh, who tragically passed away last week, was all of us – someone who wanted to know how to live a happy, meaningful life during his short time on Earth.

A concern for happiness was a major reason why the former Zappos CEO focused on transforming work culture. Happy workers made happy customers.

But to create a new work culture, Hsieh had to reevaluate how we typically think about happiness. As he wrote in his bestselling book, Delivering Happiness:

“I thought about how easily we are all brainwashed by our society and culture to stop thinking and just assume by default that more money equals more success and more happiness, when ultimately happiness is really just about enjoying life.”

Hsieh pioneered an innovative work culture centered around 10 core values – one of which was “create fun and a little weirdness.” These values helped employees connect with each other, their customers and the company’s collective mission.

Ultimately, Hsieh believed happiness, as with an effective work culture, could be derived by nurturing its essential parts: “Happiness is really just about four things: perceived control, perceived progress, connectedness (number and depth of your relationships), and vision/meaning (being part of something bigger than yourself).”

This is a lesson on good corporate governance, but also an important money lesson.

When you have the core pieces figured out, you can create an ideal whole. On an individual level, it’s about knowing what matters most to you to then build – mentally, physically and financially – the life you want.

As Hsieh encourages: “Envision, create, and believe in your own universe, and the universe will form around you.”

If your desire is to become a better steward of your money to live your ideal life, then solve this enduring money mystery: what matters most to you? What makes up the universe that you want to bring into existence?

The answer is found by identifying your personal values – family, integrity, health, generosity, self-determination, etc. Because personal happiness and meaning comes from upholding those values.

Many Americans may need to reevaluate their values. The latest General Social Survey from NORC at the University of Chicago shows only 31% say they are very happy while an equally dismal 32% are satisfied with their financial situation. Less than half of are very satisfied with their jobs.

Of course, there are a variety of social and economic factors, such as growing inequality. But it doesn’t explain why these figures have been relatively consistent for decades, even as technology has essentially made life easier. That seems to indicate we spend a lot of time and energy pursuing goals that don’t make us feel happy or satisfied. Or, maybe it’s a case of not yet recognizing what we truly value.

We are supposed to save for a house, for college, for retirement. But do any of those goals reflect what we value?

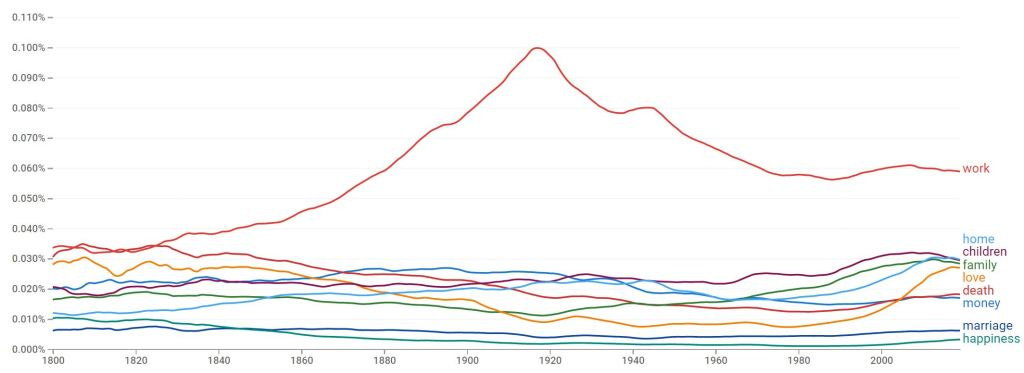

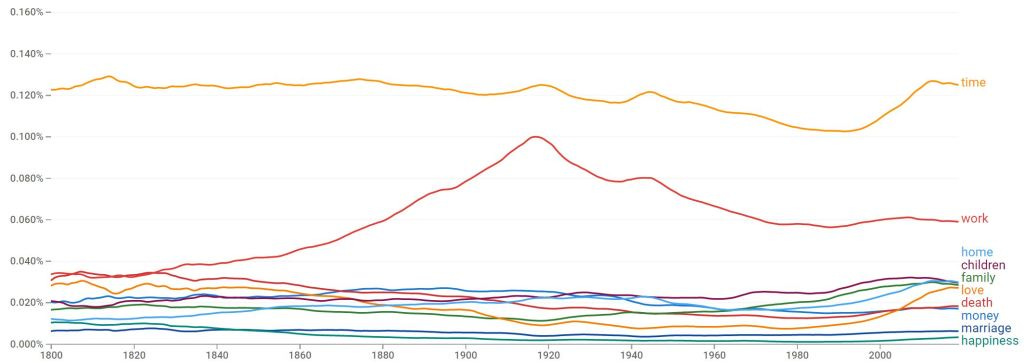

It is interesting to see what things have transfixed people over time.

The Google Ngram Viewer displays a graph that represents the use of a particular word or phrase in books through time. In a sense, it is a record of what ideas most preoccupied our lives, and perhaps a reflection of our values.

Since the 1800s, work has long been a center point of our culture and society. Is it surprising then that we always ask someone what do you do rather than what do you enjoy?

And yet, above all, there is time. We always wish we had more time; time to enjoy all those other things: our family, hobbies, relationships and, yes, even work (at least the work that we actually want to do).

If there is one reason to be financially responsible it is to reach a point where you gain complete control over your time. Save and invest wisely, you can build enough wealth to do what whatever we want for however long we want.

In my experience, those who are most financially responsible are those who most value their time.

So, how can you be sure you’re working toward the right financial goals? Start with your values.

You can establish your values with a few simple – yet extremely revealing – mental exercises. Popular among financial advisers is to pose these three life questions developed by the Kinder Institute of Life Planning:

1. Imagine you have enough money to satisfy all of your needs, now and in the future. Would you change your life and, if so, how would you change it?

2. This time, assume you are in your current financial situation. Your doctor tells you that you only have five to 10 years to live, but that you will feel fine up until the end. Would you change your life and, if so, how would you change it?

3. Your doctor tells you that you have just one day to live. You look back at your life. What did you miss out on? Who did you not get to be? What did you fail to do?

The purpose of these exercises is to uncover what matters most to you in life. Likely, it isn’t a second vacation home or perfect credit score. It is something deeper and more personal that probably involves relationships or unrealized dreams.

Focus on what matters most and adjust your life and finances accordingly. It is not about quitting your job or splurging your money as if none of that matters. Likely, it will induce you to do the opposite: work harder to become what you want to become, and diligently save to realize those long-held dreams and live life on your terms.

Your core values provide motivation for a better future. And that is where your financial goals should take you.

So, “envision, create, and believe in your own universe, and the universe will form around you.”