Are You Financially Resilient?

A young woman in the Land of Oz asks her way to Kansas. “If I were you,” she is unhelpfully told, “I wouldn’t start from Oz.” But if Oz is where you are, you have no choice; from there is where you start. That is how it is with many financial hardships. We must start where we are, in the thick of it.

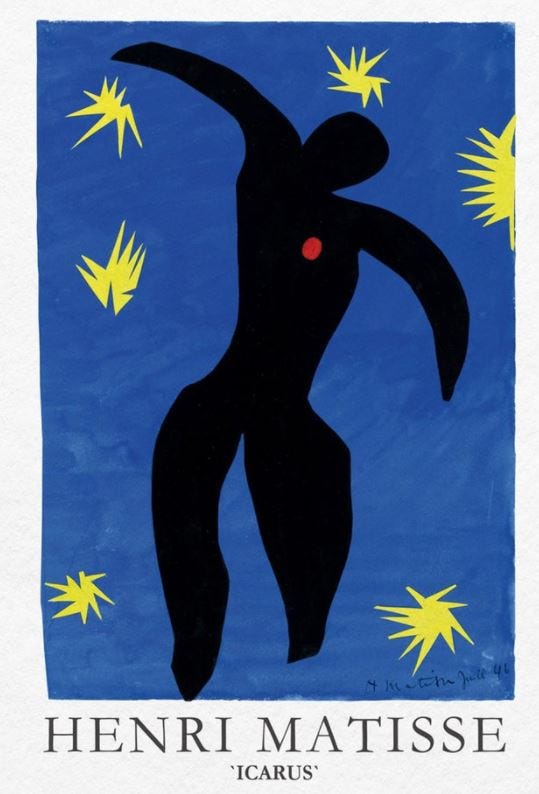

After battling stomach cancer at the age of 72, the artist Henri Matisse was confined to a wheelchair. This made it difficult to paint or create sculptures. But his passion for making art was undeterred. So, Matisse cultivated a new artistic medium: paper cut-outs. By cutting out shapes and forming collages, he created a late-stage body of work that is equally celebrated as his early paintings.

Matisse’s artistic reorientation was an act of creative resilience. The kind of resilience that’s becoming more of a necessity in our financial lives. Research from the National Endowment for Financial Education shows that 96% of Americans experience four or more income shocks -- health crisis, job loss or other life transitions during their working years -- by the time they reach age 70.

Often people face these shocks in less-than-ideal starting points. Most Americans say they would have trouble paying for a $1,000 emergency expense. The median household retirement savings for those nearing retirement (55-64) is $134,000, according to the 2019 Survey of Consumer Finances.

I like to think of financial resilience as the ability to overcome a financial hardship and still make the best of life. It is more art than science, because each person’s situation is different. But we all proceed from the thick of it.

And conditions seem to be getting thicker.

For one, life expectancy is rising, which means younger generations can expect to save more for retirement than previous ones. Of course, the downside of living longer is the chances are greater for experiencing unfortunate events.

Simply starting to save for retirement is a challenge for most young adults, who typically enter the workforce saddled with more than $30,000 in student loan debt.

Meanwhile, many people who grew up with the post-war years, when a degree was expected to translate to a good-paying job, a yearly vacation, some college savings for the 2.5 kids, and a comfortable pension or retirement fund, are finding that isn’t always so.

A survey from Allianz Life found that more than 50% of Americans are forced out of the workforce earlier than they planned. The leading reason was unanticipated job loss. Something that was experienced by around 900,000 Americans between the ages of 60-69 as a result of the pandemic, according to the Bureau of Labor Statistics. An unexpected exit from the workplace can mean missing out on additional years of peak earnings, potentially lower retirement benefits and the need to start drawing down assets early.

It is important to conceptualize your finances in concrete terms: how much to save in a 401(k), what type of investments to buy, when to file for Social Security, etc. But it is also important to think abstractly, because it is difficult to account for adversity -- a pandemic, a cancer diagnosis, the automation of your job.

Although our financial pictures are all different, the elements of financial resilience can be crafted along the lines of a paint-by-numbers kit:

1. An emergency fund of 3-6 months’ worth of expenses. The entire purpose of this money is to alleviate the pain of an unanticipated financial hit.

2. Insurance coverage -- health, home, auto, life. Sure, it’s not as sexy as gaining triple-digit investment returns, but insurance will likely save your ass more than the market. Take time to understand what your policies cover, and compare coverage by more than just the price.

3. A decent sized nest egg. The appropriate amount varies based on your desired lifestyle. But for someone who makes less than $100,000, it’s a good idea to save around 7-10 times your salary by the age of 65. That's why you want to start saving early. You can save 100k in less time than you think, setting you up for that 7-10x figure before you know it. Retirement savings are not only to help fulfill your goals or dreams, but also preserve your lifestyle as your age and health leaves you more vulnerable to financial shocks.

4. Updated job skills. Skills help us earn better pay and keep us in the game. A Brookings report estimates approximately 25% of U.S. jobs will be highly impacted by automation in the coming decades. So, it is worthwhile to learn a new skill or take an educational workshop every couple years.

5. Some kind of financial planning. Seems obvious, right? Unfortunately, many of us for myriad reasons are simply winging it. A plan won’t prevent adversity. But financially speaking, when you have a full awareness of your situation -- your cash flow, bank account balances, etc. -- you are better able to adapt.

As with Matisse, resiliency is finding a new angle. It is creating a new path so you can keep moving when the world around you, as if a whirlwind, suddenly changes. Or, in the wise words of Rumi:

“As you start to walk on the way, the way appears.”